The amount of zakawiy property of Zakat that must be issued

40 - 120 goats 1 goat (1 year old sheep or goat beans 2 years old)

121- 200 goats 2 goats (1 year old sheep or 2 year old goat)

201 - 399 goat 3 goats (1 year old sheep or goat beans 2 years old)

400 - 499 goats 4 goats (1 year old sheep or goat beans 2 years old)

500 - 599 goats 5 goats (1 year old sheep or goat beans 2 years old)

for the next, each multiples a hundred plus one goat The amount of zakawiy property of Zakat that must be issued

30 - 39 cows 1 tabi '(calves one year old)

40- 59 cows 1 musinnah (two year old calf) or 2 tabi '

60 - 69 cows 2 tabi '

70 - 79 cows 1 wicked and 1 tabi '

80 - 99 cows 2 verminnah

100 - 109 cows 1 raid and 2 tabi ' And changed every 10 cows examples: 110 cows that issued 2 vandals and 1 tabi ' The amount of zakawiy property of Zakat that must be issued

5 - 9 camels 1 goat (1 year old sheep or goat beans 2 years old)

10 -14 camel 2 goats (1 year old sheep or 2 year old bean goat)

15 -19 camel 3 goats (1 year old sheep or 2 year old bean goat)

20 - 24 camels 4 goats (1 year old lamb or 2 year old bean goat)

25 - 29 camels 1 bintu makhad 36 - 45 camels 1 bintu labun

46 - 60 camels 1 hiqqah 61 - 75 camels 1 jadza'ah

76 - 90 camels 2 bintu labun 91 - 120 camels 2 hiqqah

121 - 129 camels 3 bintu labun

130 - 139 camels 1 hiqqah and 2 bintu labun Then change every multiplied by 10 examples: 140 camels = 2 hiqqah and 1 bintu labun The name of Zakat property must be issued 5 horses 2.5%

Name of Nishob Zakat Property to be issued Percentage of Time issued / information

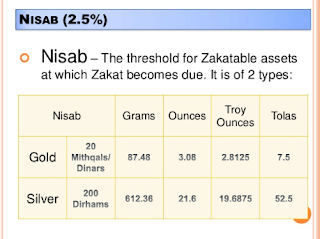

Gold 77.50 gr 1/40 = 1.9375 gr 2.5% After 1 year

Silver 543,35 gr 1/40 = 13,584 gr 2,5% After 1 year

Gold Mine 77.50 gr / 40 = 1.9375 gr 2.5% Instantaneous

Silver Mine 543,35 gr 1/40 = 13,584 gr 2,5% Instantaneous

Merchandise with Gold Capital 77.50 gr / 40 = 1.9375 gr 2.5% After 1 year

Merchandise with silver capital 543,35 gr 1/40 = 13,584 gr 2,5% After 1 year

Ricaz gold 77.50 gr / 5 = 15.5 gr 20% Instantaneous

Rikaz silver 543,35 gr 1/5 = 108,67 gr 20% Instantaneous

Grain 1323,132 kg

1323,132 kg 1/10 = 132,3132 kg

1/20 = 66.1566 kg 10%

5% No irrigation cost

With irrigation costs

Rice handle 1631,516 kg

1631,516 kg 1/10 = 163,1516 kg

1/20 = 81,5758 kg 10%

5% No irrigation cost

With irrigation costs

Rice 815,758 kg

815,758 kg 1/10 = 81,5758 kg

1/20 = 40,7879 kg 10%

5% No irrigation cost

With irrigation costs

Wheat 558,654 kg

558,654 kg 1/10 = 55,8654 kg

1/20 = 27,9327 kg 10%

5% No irrigation cost

With irrigation costs

Bean cow (otok) 756,697 kg

756,697 kg 1/10 = 75,6697 kg

1/20 = 37.83485 kg 10%

5% No irrigation cost

With irrigation costs

The green bean is 780,036 kg

780,036 kg 1/10 = 78,0036 kg

1/20 = 39,0018 kg 10%

5% No irrigation cost

With irrigation costs

Yellow maize 720 kg

720 kg 1/10 = 72 kg

1/20 = 36 kg 10%

5% No irrigation cost

With irrigation costs

White corn 714 kg

714 kg 1/10 = 71.4 kg

1/20 = 35.7 kg 10%

5% No irrigation cost

With irrigation costs

Spices Without Nishab 10%

honey 653 kg

1/10 = 65.3 kg

1/20 = 10%

5% Lowland honey

Mountain honey.

Information : - Nishob of gold on the list above is that the nishob is pure gold (gold with 100% content). Meanwhile, to find the nishob of gold is not pure way nishob pure gold divided by the amount of impure gold then the result multiplied by the level of pure gold. Formula: 77.50 (the nishob is pure gold): 90 (90% gold content) x 100 = 86,1111. So the nishob of gold with 90% content is: 86,1111 grams.

Zakat to be issued;

2.5% (1/40) = 2.15277 grams.

20% (1/5) = 17.2222 grams.

Zakat Fitrah Compulsory for Everyone who is still alive at the end of Ramadlan and at the beginning of Shawwal at the same time Zakat Level issued about 3 kg From the staple food of his country

Note: According to Hanafi madhhab, in the honey zakat is not required nishab. But (the wasps) should be indulged in plants that are not obliged to zakat. If the bees are indulged in plants that are obliged to zakah such as date or wine flowers, then the honey is not obligatory zakat. Summarized by: Tim Muroja'ah PPS & Lajnah Bahsul Masail PCNU Kab. Sakera Mania Tretes-Pasuruan.